Will It Make Me Sweat?

My friend Tyson moved to Napoleon in the 5th grade. His dad got transferred from Detroit by Imperial Clevite, an auto parts manufacturer. By junior high, we’d become pretty close. I enjoyed going over to their house and going on road trips to away Napoleon HS football games to see Tyson’s brother Eric play. His mom Marge was the “fun mom”. She made us popcorn and nachos. She knew who shot JR on Dallas. And sleepovers were not only encouraged, Marge didn’t mind us toilet papering in the neighborhood.

Among my favorite memories were trips to Cincinnati. I’d never been to Cincinnati with my family. It was a 4-hour ride by my dad’s math, and we were American League baseball fans, so going to see the Reds wasn’t part of the plan. Cedar Point was 90 minutes away, so no reason to make the trek to Kings Island.

That changed with Tyson. Tyson’s brother Eric went to UC, studying architecture. Marge liked to visit her oldest son and we got to tag along. In addition to being “fun mom”, she was also lead foot mom. I’d never been pulled over before. That changed when Marge got pulled over on I-75. I heard a lot of swear words I didn’t know moms knew, let alone used.

Anyways, the highlight of the trip was that we stayed in the Holidome that used to be off the Sharonville exit on I-75. Holidome’s were Holiday Inn’s version of the fun house. Besides a hotel room, the holidome had ping pong, pool and arcade games. My dad viewed arcade games as the easiest way to throw a quarter out the window. The concept of paying for entertainment was completely lost on him. Marge was all in and I got to play Ms Pac Man, Gorf, and Galaga to my heart’s content.

Probably the most enduring memory I have, though, is of running between the pool and the hot tub. The hot tub was a completely new concept to me. And being 13, the temperature extremes were exhilarating rather than traumatic. We would get in the pool for awhile and swim followed by running over to the hot tub for 10 minutes or so. Once we got hot, we would jump back into the pool for a jolt of “cold” water. We did that for what seemed like hours. Hot tubs must’ve been a cultural phenomenon too, because Eddie Murphy famously did his SNL sketch in 1983 where he parodied James Brown. The song? “In the hot tub”. The most famous line from the sketch… “Will it make me sweat”?

———————————————————————————————————————————

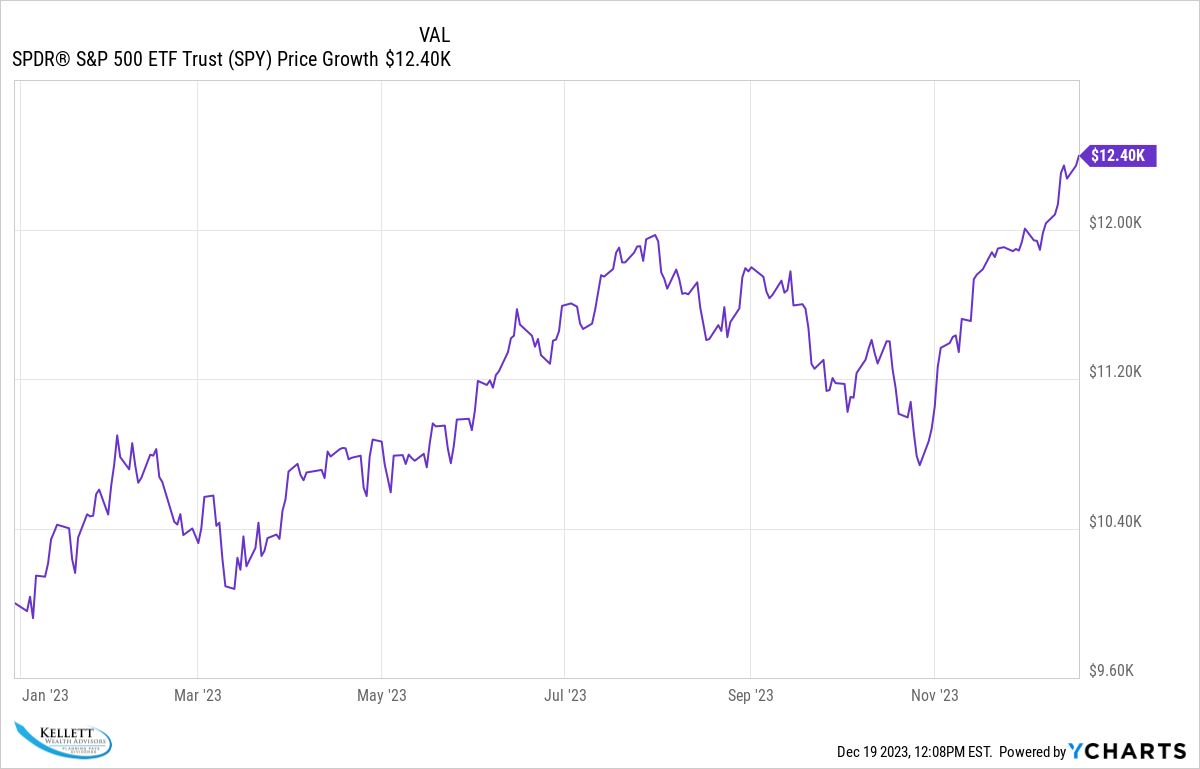

The market in 2023 has been a dip in the cold pool, followed by a jump in the hot tub. Here is the S&P 500 chart as illustration (the chart shows $10,000 invested January 1).

Small caps have been even more pronounced (the chart shows $10,000 invested January 1).:

What’s behind the move? Especially in the case of small caps, it appears that interest rates in the US have topped out and are heading back down. This has caused the US Dollar to weaken. The combination of these two events, especially since late October, has caused two significant trends in the markets, and as a result, in most portfolios – small caps and bond values have really taken off. The first chart represents small caps since October 27, the second is a commonly quoted bond fund.

We think this has room to run, at least into the new year. As long as the dollar weakens and interest rates moderate (as inflation continues to cool), we see continued gains in the market. Economists have dubbed a time like this “goldilocks” – the economy is not too hot, nor too cold.

All of that said, I’ve mentioned storm clouds on the horizon a couple times. In geeky economic terms, there are indicators that help us understand where we are in the business cycle. They are usually dubbed leading, coincident and lagging indicators. One such coincident indicator is “average weekly hours worked in manufacturing”. When that number starts to head under 40, it’s usually a sign we are heading toward a recession. The chart below shows we are headed there, albeit slowly:

At the moment, we are enjoying the goldilocks nature of the market. With interest rates stable to dropping, the dollar weakening and inflation on the wane, we like the market. But we also are looking for bond funds to replace the Treasuries. If the Fed cuts interest rates later in 2024, we will want to be in bond funds. And we may lighten up our stock positions in anticipation of a slowdown. After all, if the market gets too hot, we don’t want to ask, will it make me sweat?

Jared

Brian Kellett, brian@kellettwealth.com. Phone 513-312-6067

Dave Bodnar, david@kellettwealth.com. Phone 513-258-6973

Jared Kline, jared@kellettwealth.com. Phone 513-768-2238

YCharts are put together by me, Jared Kline. The “average weekly hours” chart was created by Henrik Zeberg for his weekly market update.

Kellett Wealth Advisors LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Kellett Wealth Advisors LLC and its representatives are properly licensed or exempt from licensure. This website is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Kellett Wealth Advisors LLC unless a client service agreement is in place.