Is it time to convert?

Why convert investments from a traditional IRA to a Roth IRA? In a sentence: if you pay taxes now, you will never pay taxes again. You don’t pay taxes on the principle when you remove it, nor do you pay on the earnings generated by the investments…….

The mainstream financial press spends a lot of time talking about “backdoor Roth conversions”. Most of that literary energy involves contributing $6,500 ($7,500 if the person is 50 or over) of after-tax contributions into an after-tax, non-deductible IRA. The strategy then involves converting that non-deductible IRA money to a Roth where the money grows tax free. There are two complexities to this strategy which makes it only moderately advantageous. First off, at $6,500 annually, it takes a looooooong time for this strategy to pay dividends. It would take 20 years to put away $130,000 in backdoor Roth conversion money. Second, if a person has an existing non-Roth IRA, the IRS incorporates a rule that creates complexity and limits the amount that can be converted tax-free. I won’t go into all the details, but an individual doesn’t get to do a completely tax-free conversion as long as they have an existing IRA. Here is an example to illustrate how this works:

Larry contributes $5000 in after tax contributions to a non-deductible IRA. His total IRA balance (specifically, his non-Roth IRA total) is $100,000. That means 5% of his contributions are not taxable ($5,000/$100,000). If Larry converts $5,000 into a Traditional Roth, 5% of the $5,000, or $250, is not taxable. The remaining $4,750 is taxable when converted.

We think a much more powerful opportunity is to convert your traditional IRA to a Roth IRA. Money in a traditional IRA hasn’t been taxed. When a person converts that to a Roth IRA, they pay ordinary income tax on the amount they convert. BUT, that money, once in the Roth, grows tax free. In addition, that money isn’t subject to Required Minimum Distributions (RMD) later, giving the person far more flexibility in utilizing the invested assets later in life. Further, those Roth assets can be transferred tax free to heirs, and those heirs avoid RMD’s.

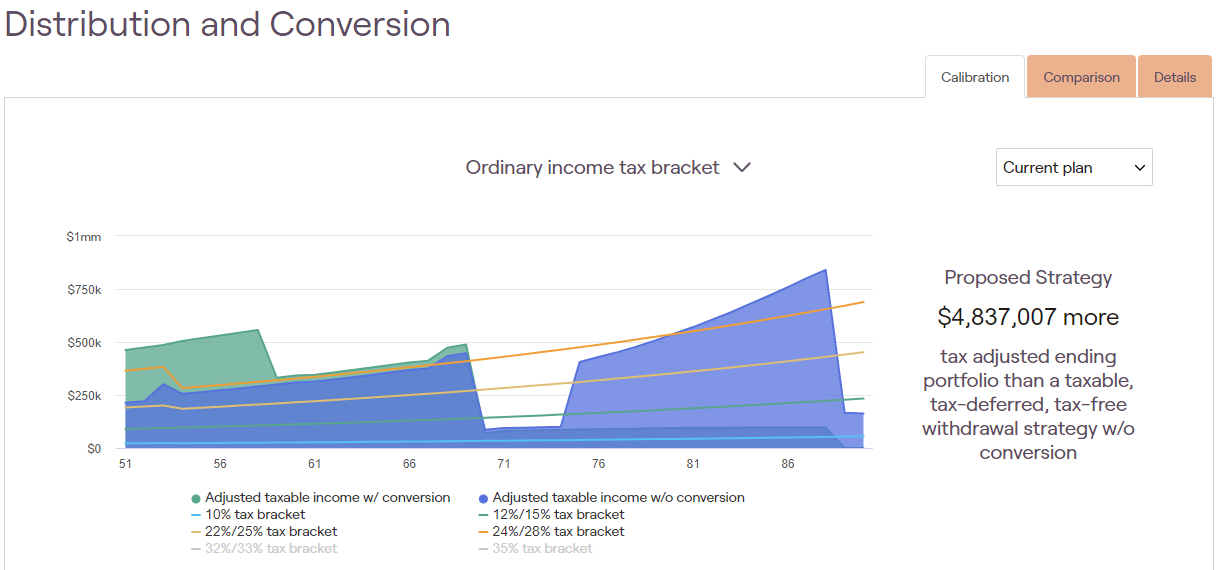

Here is an example. This is a couple that are Kellett Wealth clients. They have $1.2 million in a traditional IRA. The recommended conversion years for this couple are from age 51 to 58. Executing this set of conversions results in an estimated $4.8 million more in invested assets.

In this particular case, it makes sense for the couple to convert almost $250,000 annually from their IRA into a Roth and do such a conversion for each of the next 8 years.

We have another client couple who are offered a slightly different opportunity. Both spouses are 70 and they have $1.3 million in traditional IRA’s. Because converting too much would push them into a higher Medicare tax bracket, we recommended they convert ~$110,000 this year and in the two following years. We will re-evaluate again in a couple of years to determine how much more to convert further down the road.

Each client situation is different and requires understanding a full financial picture. In addition, while the software may suggest a certain dollar amount to convert, we work with each client to understand how they would pay the tax bill that is created and whether to be conservative or aggressive in how much we convert based on their individual situation. If you would like to sit down with us for a free financial plan and review of a possible Roth conversion, give us a call or email us.

Jared

Brian Kellett, brian@kellettwealth.com. Phone 513-312-6067

Dave Bodnar, david@kellettwealth.com. Phone 513-258-6973

Jared Kline, jared@kellettwealth.com. Phone 513-768-2238

Kellett Wealth Advisors LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Kellett Wealth Advisors LLC and its representatives are properly licensed or exempt from licensure. This website is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Kellett Wealth Advisors LLC unless a client service agreement is in place.